Hi, we're looking for banks, PAG-IBIG, lending companies, etc that offers the lowest annual interest rates and charges on housing loan.

Please feel free to post if you know any of the ff:

- loan amount bracket and corresponding term

- interest rate per annum (diminishing or fix)

- charges (service charge, etc), fees and penalty (late payment)

- requirements (will be using employed status)

- without collateral

We're planning to have it spot cash with 0% staggard payment sa in-house financing unta pero Bank Financing mn ila nabutang. Naka-realize sad mi nga it's better to loan nlng ky we can still use the money on other things and di siya bug-at if longer payment term.

When needed: approx. March to April 2013 pa.

Mods, if ever with duplicate na. Please delete nlng this post. Thank you.

UPDATE: Housing Loan

1. Banks

a. Interest Rate

- ranges from 5 to 12 % p.a.

- so far, diminishing

b. Bank charges

- comprise appraisal fee doc stamp, etc

- may reach upto 30k+ for 1M Principal Loan

c. Years of fixing

- Yearly, 2 years, 3 yrs., 5 yrs., 10 years or full term fixed rate.

- The longer the duration of years of fixing, the higher the interest rate.

(You can decide on the number of years of fixing according to your capacity to pay and to how you view the market trend.)

d. MRI (Mortgaged Redemption Insurance)/ CLI (Credit Life Insurance) & Fire Insurance

- pwede attach sa ila and to your amortization or you get it separately

- payment may be staggard or annually.

- Yearly renewable and is dependent to the outstanding principal amount

Full Payment of Loan:

a. Notarial Fee

b. Letter of Release/ Cancellation of Mortgaged Annotation

c. Acceleration Fee (may not be applicable to some banks)

Cancellation of Mortgaged Annotation:

- To be processed by the client's end.

Where: Registry of Deeds

Maceda Law: "Rights of a Defaulting Buyer under RA 6552"

Spoiler!Spoiler!

Source:

HLURB Link: http://old.hlurb.gov.ph/services/buyers/right-to-a-clean-title/rights-of-a-defaulting-buyer-under-ra-6552/

Other source/s: R.A. 6552

Transfer of Title through Deed of Sale (Non-Corporation):

1. Secure Checklist form at Registry of Deeds

Documents Needed:

1. Deed of Sale

2. BIR CAR/ Tax Clearance Certificate

3. Documentary Stamp Tax Receipt

4. Owner's and all issued Co-Owner's Duplicate Certificates

5. Realty Tax Clearance

6. Tax Declaration (Certified Copy) at Assessor's Office

7. Transfer Tax Receipt at Land Tax Office

Source: Registry of Deeds

Results 1 to 10 of 165

Thread: Housing Loan

-

08-09-2012, 09:29 AM #1

Housing Loan

Housing Loan

Last edited by cebu.opportunities; 01-27-2016 at 10:57 AM.

-

09-16-2012, 07:09 PM #2

Re: Housing Loan

Re: Housing Loan

Housing Loan sa Metrobank

- 6-7% p.a. for 3 years term.

(Last September 2012)

Updates: March 05, 2013

Imp't qualifiers for collateral:

1. Condo

- must be at least 30 sq.m.

2. Lot

- Loanable amount is only 60% of the appraisal value

Payment options:

1. Post-Dated Checks

2. Over-the-Counter

3. Auto-Debit

Advance Payment:

- will be acknowledged only per anniversary date of loan

- at least 6 months of amortization or (current month amortization plus 5 months advance payment)

Note: Both Metrobank and PS Bank will not easily give you the list of loan requirements not unless the property is affiliated and you are more likely legible for their housing loan.Last edited by cebu.opportunities; 03-06-2013 at 07:22 PM.

-

01-25-2013, 09:39 PM #3

BPI or BPI Family Housing Loan

Interest Rates (p.a.) as of January 04, 2013: House and Lot

(source: seminar)

1 year - 7.50%

2 to 3 years - 8.75%

4 to 5 years - 9%

6 to 10 years - 10%

11 to 15 years - 11%

16 to 20 years - 11.5%

Interest Rates (p.a.) as of January 23, 2013: Condo

(source: BPI personnel)

1 year - 6%

2 to 3 years - 7.75%

4 to 5 years - 8%

10 years - 10%

Interest rates

- can be fixed on a given term and be fluctuating thereafter; can be fixed all throughout the loan term

- diminishing interests

Payment

- no preterm payment penalties

- no advance payment charges

- interest is fix for the month's loan balance and the add-on payment to the amortization will be deducted to the principal amount

Fees

- Appraisal Fee of P3.5K (as of Jan. 2013); Appraisal fee will be waived if property is of affiliated developer.

- Mortgage Registration fees

- Mortgage redemption insurance premium

- Fire/Lightning/ Typhoon/ Earthquake/ Flood (Acts of Nature) insurance premium

- Notarial Fee

- Life insurance (not in the list but spoken by the Loan Banking Relationship Manager)

- if with existing life insurance, no need to secure another life insurance unless,- your "pre-granted" loan amount is higher than the amount insured;- Amount insured should equate or at least be with the similar amount but to be less than the loan- In cases that the amount insured is lesser than the loan amount, secure another life insurance plan to suffice the principal amount.- If the amount insured in a single Life insurance Policy is way higher than the loan amount, a portion of it will just be used to pay the bank in case of the borrower's death.

-

01-25-2013, 09:50 PM #4

bye the way wala ko kagets sa pama age aning housing loan...pwede can someone can explain mi regarding this maater?? until now naglibog pa gihapon ko ani......

-

01-25-2013, 09:57 PM #5

BPI or BPI Family Housing Loan

- 5 working days of credit decision

Steps: Condo

A. Credit Assessment, Appraisal and Evaluation

1. Secure the term sheet from the developer which contains the ff:

- Unit Number

- Appraisal Value or Total Contract Price

- Your name

- Term, Installments and (amount paid-- may not be included)

2. Basic Application

- Duly accomplished application form

3. Income document (depending on income source)

- If ITR (Income Tax Return) or income shows incapacity to pay, co-borrower is needed.

- Amortization is based on 40% of your monthly income.

4. Collateral Documents

5. Fees

Checklist of Requirements

For all applicants:

- Duly accomplished application form

- Marriage Contract (if married)

- 2 Government Issued ID's

- Latest Residence Certificate (Cedula)

- 1pc. 2x2 picture

If LOCALLY employed:

- Certificate of employment (COE) indicating salary, position and length of service

- Latest Income Tax Return (ITR)

- 3 months payslips/paystubs

- 3 months bank statement

If OFW:

- Certificate of Employment (COE) with email address of supervisor or HR

- Latest Contract and Certificate of Employment from agency (for seaman)

- Original payslips for the last 3 months

- Proof of remittance for the last 3 months

If Self-Employed:

- Articles of Incorporation/By-laws/SEC Registration

- DTI Registration

- Mayor's Permit or Business Permit

- Latest Income Tax Return

- Bank statements for the past 3 months

- List of Trade references (at least 3 names w/ telephone nos. of major suppliers/customers)

If Practicing Doctor:

- Clinic addresses and schedules

- Bank statements for the past 3-6 months

- Latest Income Tax Return (ITR)

If from Commission:

- Vouchers/ Bank Statements (for the last 6 months reflecting commission income)

If Pensioners:

- Pension Papers

- Proof Pension - Bank Statements or Receipts

If from Rental of Properties:

- Rebtal/ Lease contracts (indicating name of tenants and rental amounts w/ complete addresses of properties being rented)

- Photocopy of Title (TCT/CCT)

Additional Requirements:

- Citizenship Retention Certificate or Oath of Allegiance (for dual Citizens)

- Transferees Affidavit (for naturalized foreign citizens)

Collateral Documents:

- Photocopy of Individual TCT/CCT (Owner's Duplicate Copy; 2 copies)

- Photocopy of Tax declaration on lot and building

- Photocopy of Tax Receipt/Tax clearance

- Lot Plan / Vicinity Map

- Non-refundable Appraisal Fee of P3,500.00

Collateral Documents (Construction):

- Photocopy of Individual TCT/CCT (2 copies)

- Photocopy of Tax declaration on lot and building

- Photocopy of Tax Receipt/ Tax Clearance

- Lot Plan / Vicinity Map

- Bill of Materials

- Building Plan

- Building Permit from OBO

- Non-refundable Appraisal Fee of P3,500.00

- Statement of Account from developer / Term Sheet (if collateral is accredited)Last edited by cebu.opportunities; 02-12-2013 at 07:30 PM.

-

02-03-2013, 08:18 PM #6

PAG-IBIG

Individual Home Financing Program

HDMF Circular 310

Enhanced Housing Loan Program: year 2013

- increased Maximum Loan to PhP 6M

- Enhanced Portfolio Categorization

I. Affordable Housing Loan

II. Regular Housing Loan

Who are eligible?

1. All Active Pag-IBIG members with:

- at least 24 months contributions

- not more than 65 years old at the date of loan application, insurable and is nor more than 70 years old at the date of loan maturity

- legal capacity to acquire and encumber real property

- No outstanding Pag-IBIG housing loan

- No Pag-IBIG housing loan foreclosed, cancelled, bought back, or voluntarily surrendered

- If with existing Pag-IBIG Multi Purpose Loan (MPL), payments should be updated upon Housing Loan application

Loan Purpose:

- Purchase of residential lot

- Purchase of house and lot, townhouse or condominium unit (old, new or acquired asset)

- Construction or completion of residential unit

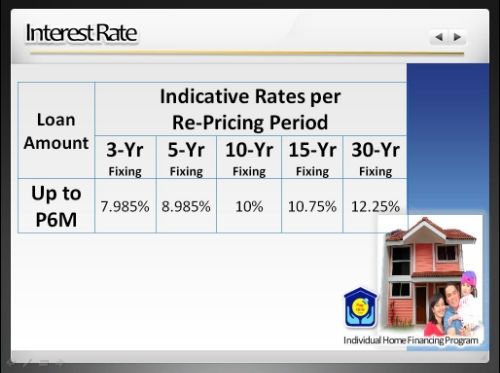

Interest Rate: Affordable Housing

Loan Amount- Loans up to 400K

Interest- 4.5%

Cluster 1 (NCR)- GMI up to 15k

Cluster 2 (REGIONS)- GMI up to 12k

Loan Amount- Loans up to 750K

Interest- 6.5%

Cluster 1 (NCR) - GMI up to 17.5k

Cluster 2 (REGIONS) - GMI up to 14K

Regular Housing Loan

Loan Purpose:

- Purchase of residential lot or adjoining lots (max 1,000 sq.m.; min 28 sq.m.)

- Purchase of house & lot, townhouse or condominium unit (adjoining units)

- Construction of house

- Improvement of house

- Refinancing of an existing loan

Combined Loan Purposes:

- Lot purchase with house construction

- Purchase of residential unit with home improvement

- Refinancing with home improvement or house construction

-

02-04-2013, 05:27 PM #7

-

02-12-2013, 01:02 AM #8Junior Member

- Join Date

- Jul 2003

- Posts

- 437

naa mi silingan baligya nila house and lot for 2.5M please give me checklist unsa requirements ug mga fees. btw, seaman diay ko. thanks!

-

02-12-2013, 11:37 AM #9

PAG-IBIG continuation...

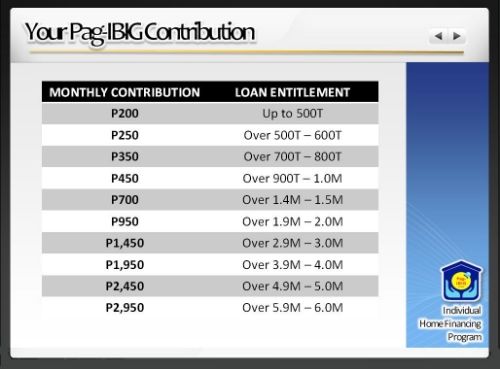

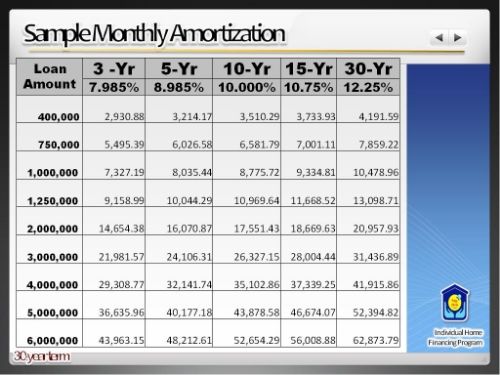

Monthly Contribution for Entitled Loan:

Loan Amount:

Shall be based on the lowest of the following:

1. Actual Need

a. PRU: Selling Price

b. House Construction: Total Construction Cost

c. Refinancing: Outstanding Balance

2. Capacity to Pay

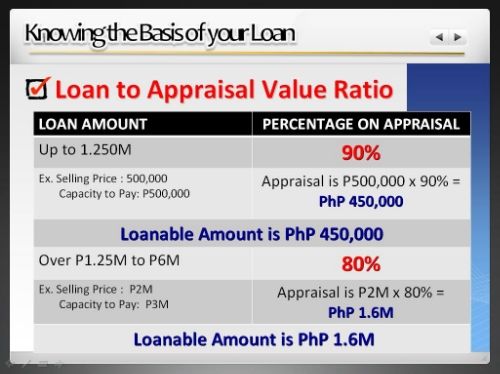

a. 35% of your Gross Monthly Income, for loans up to P1,250,000

b. 30% of your Gross Monthly Income, for loans over P1,250,000

c. Tacking Provision: Maximum of three (3) qualified Pag-IBIG members

3. Loan-to-Appraisal Value Ratio

Loan Term:

- Maximum of up to 30 Years provided that:

----> Principal borrower's age shall not exceed 70 years old at date of loan maturity.Last edited by cebu.opportunities; 02-12-2013 at 12:46 PM.

-

02-12-2013, 11:41 AM #10

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote