dapat regular ky pra "secured" ang bank nga naa jud klaro nga work and maka-pay pa sa loan within the loan term (though di gihapon guaranteed but at least mas kampante sila kysa sa contractual/probitionary nga wa pay sure nga ma renew ag contract... pero kana mga seaman, mura mn pud na by contract ilaha but dawaton na sila sa bank.

kana per project ang source of income pero dako og sweldo, try lang ask basi ma grantan ra gihapon. case-to-case basis mn pud na.

Results 31 to 40 of 165

Thread: Housing Loan

-

05-22-2013, 08:59 PM #31

-

05-30-2013, 12:50 PM #32Newbie

- Join Date

- Mar 2013

- Gender

- Posts

- 41

-

05-30-2013, 01:31 PM #33

You might want to check on their website:

HDMF Official Site

http://www.pagibigfund.gov.ph/home_p...0Availment.pdf

di lang na updated pero gamay ra ang changes.

pra sigurado, prepare lang requirements similar giask sa banks and addition to the standard loan requirements ky kana required sa PAG-IBIG. kato 24 months contribution (savings).

Basic Requirements:

1. Housing Loan Application (HLA)

2. Membership Status Verification Slip (MSVS)

3. Additional Requirements (Refer to pages 14 to 16 as indicated sa 2nd link)

DOCUMENTS REQUIRED UPON LOAN APPLICATION

1. Housing Loan Application (2 copies) with recent ID photos of borrower

2. Membership Status Verification Slip (MSVS)

3. Proof of Income

3.1 For Locally Employed, any of the following:

a. Notarized Certificate of Employment and Compensation (Employer’s

format) and for government employees one (1) month payslip, within 3

months prior to date of loan application

b. Latest Income Tax Return (ITR) for the year immediately preceding the

date of loan application, with attached W2 form, stamped received by the

BIR/Certificate of Tax Withheld (BIR Form No. 2316)

3.2 For Self-Employed/Other Sources of Income, any of the following:

a. ITR, Audited Financial Statements, and Official Receipt of tax payment

from bank supported with DTI Registration and Mayor’s Permit/Business

Permit

b. Commission Vouchers reflecting the issuer’s name and contact details (for

the last 12 months)

c. Bank Statements or passbook for the last 12 months (in case income is

sourced from foreign remittances, pensions, etc.)

d. Copy of Lease Contract and Tax Declaration (if income is derived from

rental payments)

e. Certified True Copy of Transport Franchise issued by appropriate

government agency (LGU for tricycles, LTFRB for other Public Utility

Vehicle or PUVs)

f. Certificate of Engagement issued by owner of business

g. Other document that would validate source of income

3.3 For Overseas Filipino Workers (OFWs), any of the following:

a. Employment Contract (with English translation if in foreign language)

b. Original Employer’s Certificate of Income (with English translation if in

foreign language). If document submitted is photocopy, it shall be duly

certified/initialed by Pag-IBIG Fund Information Officer assigned in the

country where the member works.

c. Other Proofs of Income, whether original or photocopy, shall be duly

certified/initialed by Pag-IBIG Fund Information Officer assigned in the

country where the member works.

4. Photocopy (back-to-back) of one (1) valid ID of Principal Borrower and Spouse,

Co-Borrower and Spouse, Seller and Spouse and Developer’s Authorized

Representative and Attorney-In-Fact, if applicable.

5. Authorization to Conduct/Credit Background Investigation

6. For OFW members, Special Power of Attorney notarized prior to date of

departure or duly certified and authenticated by the Philippine Embassy or

Consulate in the country where the member is staying, if abroad. If SPA is

without the red ribbon of Consulate Office, the SPA must have a duly stamped

notarial seal.

7. Insurance Coverage

a. Health Statement Form (Medical Questionnaire)

OFW members over 60 years old

Loans over P2.0 M to P6.0 M and for borrowers aged up to 60 years old

b.Health Statement Form (Medical Questionnaire) and Full Medical Examination

Borrowers over 60 years old

8. Marriage Contract (For all married borrower/s and co-borrower/s)

9. Birth Certificate or any proof of relationship, if with co-borrower/s

10. Certified true copy of Transfer Certificate of Title (TCT) (latest title)

11. For Condominium Unit, Certified True Copy of present TCT and CCT

12. Photocopy of Updated Tax Declaration and Updated Real Estate Tax Receipt

13. Location Plan and Vicinity Map

14. For new member or member with less than the required number of monthly

savings, photocopy of Pag-IBIG Fund Receipt (PFR) representing lump sum

payment of monthly savings.

15. Approved letter request to re-avail of a Pag-IBIG housing loan (for member/s with

housing loan that was foreclosed, cancelled, bought back due to default or

subjected to dacion en pago).

The Pro-forma Health Statement Form (Medical Questionnaire) is available at the

Members Services Support Division-Servicing Department for NCR or at any Pag-IBIG

Regional Branch or downloadable from the Pag-IBIG website, HDMF Official Site.

Additional Requirements Depending on the Loan Purpose

For Purchase of Residential House and Lot, Townhouse or Condominium Unit,

Purchase of Lot and Construction of House, Purchase of a Fully Developed

Lot/Adjoining Lot

1. Contract to Sell or similar agreement between the buyer and the seller. If the

Seller is a Developer, submits the following documents:

a. Certificate of Registration, License to Sell, Development Permit, and

Secretary’s Certificate

b. Photocopy of back to back valid primary ID from Corporate Secretary

For Purchase of Lot and Construction of House, Construction of House, Home

Improvement

Building Plans, Specification and Bill of Materials duly signed by the Licensed Civil

Engineer or Architect, Building Permit

For Refinancing

1. Statement of Account on outstanding loan balance, indicating loan purpose

2. Any of the following documents:

Official Receipt for the past 12 months

Subsidiary Ledger

Any valid proof of payment for the past 12 months

DOCUMENTS REQUIRED PRIOR TO LOAN RELEASE

1. TCT/CCT in the name of the borrower (if applicable) with proper mortgage annotation

in favor of Pag-IBIG Fund (Owner’s Duplicate copy)

2. Certified true copy of TCT/CCT in the name of the borrower/co-borrower/s (if

applicable) with proper mortgage annotation in favor of Pag-IBIG Fund (RD’s copy)

3. For properties that are subject of an heirs lien under Section 4 Rule 74 of the Rules

of Court, surety bond (not an heir’s bond) that shall answer for the payment of the

outstanding loan obligation still due to the Fund in the event that another person

including an heir of the registered owner would lay a claim against the property

offered as security

4. Photocopy of New Tax Declaration and Updated Real Estate Tax Receipt in the

name of the borrower and co-borrower, if applicable

5. Notarized Loan and Mortgage Agreement duly registered with Registry of Deeds with

original RD stamp

6. Duly accomplished/notarized Promissory Note

7. Disclosure Statement on Loan Transaction

8. Collection Servicing Agreement with Authority to Deduct Loan Amortization or Post

Dated Checks, if applicable

9. Proof of Billing Address

Additional Requirements Depending on the Loan Purpose

1. Occupancy Permit (for Purchase of New Residential Unit, Purchase of Lot and

Construction of House, Construction of House, Home Improvement)

2. Building Plans/Electrical/Sanitary Permits duly approved by the building officials

(for Purchase of Lot and Construction of House/Construction of House/Home

Improvement)

3. Deed of Absolute Sale duly registered with Registry of Deeds with original RD

stamp (for Purchase of Lot/Adjoining Lot, Purchase of Lot and Construction of

House and Purchase of Residential Unit )

-

05-31-2013, 02:53 AM #34Senior Member

- Join Date

- May 2013

- Gender

- Posts

- 814

-

05-31-2013, 08:22 AM #35

@april,

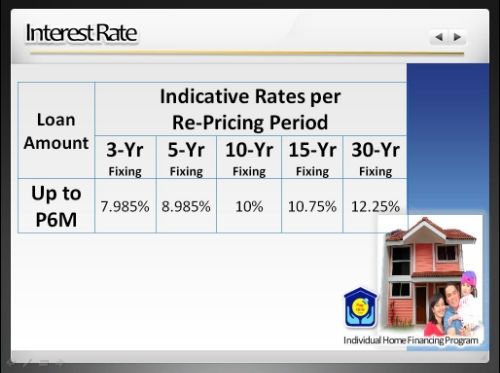

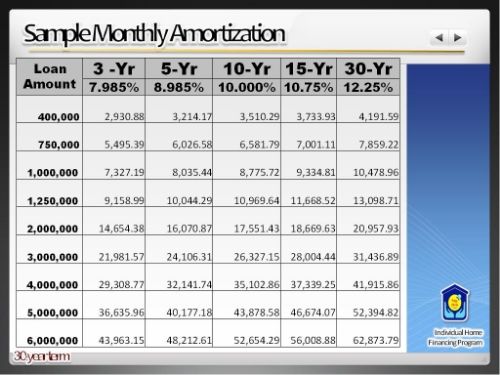

fixing of interest rates na siya sis, not the loan term.

let's say, you choose the 10-yr fixing of interest rate so for the entire 10 years, 10% ang interest rate regardless mosaka or moubos ang rates the following year and the year after next and so on. inig ka 10th anniversary date sa loan, that's the time mo change whenever naay changes sa rates for the specified fixing term.

pwede man 10-years fixing (of interest rate) imo gipili dayon ang loan term ky 30 years (to pay).

"fixed ang interest rate for 10 years unya 30 years ka magbayad sa loan. 30 years (loan term) divided by 10 years fixing so katulo mag-change ang interest rate for the entire loan term unless significant advance payments have been made (which in this case may lower the loan term)."

-

05-31-2013, 03:43 PM #36Newbie

- Join Date

- Apr 2013

- Gender

- Posts

- 12

thanks for sharing nice information about the house loans..........

-

05-31-2013, 11:27 PM #37

UnionBank's fixing rates:

1 year fixing = 9.75%

2-3 years fixing = 10.5%

10 years fixing = 11. something %

note:

- advance payment can be done during loan anniversary date.

- bank charges is approx. 3 to 5% of the loanable amount

- if the property is 2nd hand, approx. 70% of the current appraisal value ang pwede ma loan.

source:

Union Bank Account Officer- Housing Loans Dep't

as of May 24, 2013

-

06-01-2013, 12:53 AM #38

-

06-01-2013, 01:00 AM #39

@baju83, replied.

sorry if safe ra kaayo ako tubag. it's just that there are still lots of things to consider before makaingon ka which is best for you. hope it somehow gives you an idea which will you choose.

-

06-01-2013, 04:26 AM #40

thanks sa reply sis.. mao lagi dapat huna2x.on gyud pag ayo.. ^_^

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote