So.... approve na ni? or naa pay additional hearing/review?

1. sugar-sweetened beverages and carbonated drinks

House - eyeing a provision imposing an additional P10 excise tax on sugar-sweetened beverages and carbonated drinks

2. Tax Program

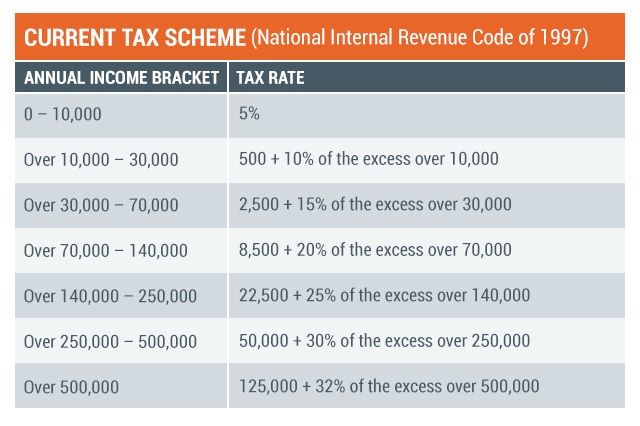

Those earning P250,000 or below annually will be exempted from paying income taxes. The mandated 13th month pay up to P82,000 as well as other bonuses will still be tax-free.

The "ultra-rich," who comprise 0.1% of taxpayers, will be levied a higher rate of 35% from the current 32%.

Current

AFTER

in comparison, if 500k imong yearly income...

your Current tax = 50k + 50k(30% of 150k excess)

vs

your New dutertetax = 22.5k + 20k (20% of 100k excess)

you save around 60k in taxes

BUTTT!

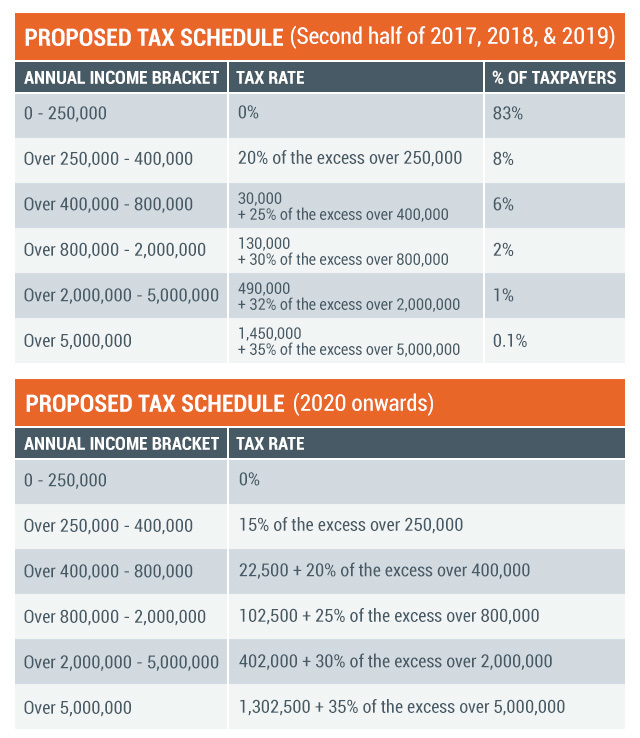

3. Excise tax on fuel

by 2020, P10tax per litter sa gas and P6 sa diesel.

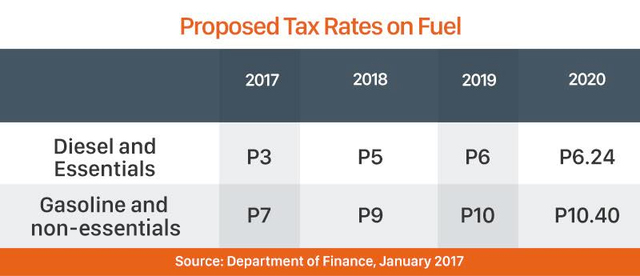

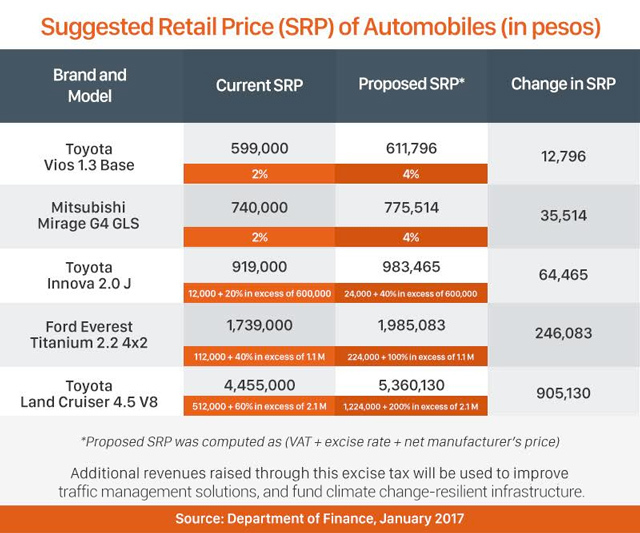

4. TAXES on new cars

here's a sample computation

unsa gahay tax for new houses(?), will check on these pa. so far, i've only read that they plan to remove VAT taxes on low cost housing.

Source:

Duterte's tax reform: More take-home pay, higher fuel and auto taxes

CTRP 'cornerstone' of infra buildup funding - Department of Finance

House committee approves Duterte tax reform package

Results 1 to 10 of 33

Thread: Dutertenomics - Tax Reforms

-

05-04-2017, 01:31 PM #1

Dutertenomics - Tax Reforms

Dutertenomics - Tax Reforms

-

05-04-2017, 05:07 PM #2

its so illogical if all taxes will be brought down.. across the board..

its like knocking our foreheads on the concrete wall.

-

05-04-2017, 05:30 PM #3

All taxes go down except for people earning 5million+ per year.

if you belong to the 1% earner, your tax has increased from 32% to 35%.

Gasoline prices/new cars/sugar breverages increases by a lot.

if wala ka nag work or not not paying taxes yet (like students/retired/smalltime earner), karon, you are forced to pay these excise tax especially sa Gasoline.

-

05-04-2017, 09:06 PM #4Junior Member

- Join Date

- Aug 2014

- Gender

- Posts

- 110

Why tax fuel? It is essential to our needs man. Unlike new cars, sweetened drinks, and cigarettes.

-

05-04-2017, 09:26 PM #5

-

05-04-2017, 09:34 PM #6Junior Member

- Join Date

- Aug 2014

- Gender

- Posts

- 110

-

05-05-2017, 04:57 AM #7

Implemented nani 2nd half of 2017 or proposition ra?

nindut sad ni from 30% to 20% income tax.

-

05-05-2017, 07:13 AM #8Banned User

- Join Date

- Sep 2007

- Gender

- Posts

- 422

@jiro if mo base ko sa montly na income for example akong sweldo is 18K/month, wala naku tax? or what if akong sweldo 25K/month

-

05-05-2017, 07:22 AM #9Banned User

- Join Date

- Sep 2007

- Gender

- Posts

- 422

-

05-05-2017, 07:27 AM #10Banned User

- Join Date

- Feb 2017

- Gender

- Posts

- 41

In my understanding low to zero income tax gives more savings, while high gasoline taxes inflate consumer goods prices/ cost of living and take your savings back. LOL

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote