FAMI AND PAMI OR FEMI are not covered by insurance commission since they are mutual funds and not variable life insurance products.

and if you are looking for a safe investment, their is no such thing as safe investment eversince the world began, EVERYTHING has a RISK but the good thing in RISK TAKING is that it has a Greater Rewards than not taking a RISK at all.

A very good example is crossing the street do you think you are safe in crossing? is there a risk involved? yes there is but the reward is that by crossing the street naa diay didto imong hinigugma... see that's how risk taking is. kung wala ka nitabok di nimo maka feeling ang imong hinigugma.Example rana i hope you get my point.

Invest now...

heres a good link to invest

Axa Variable life(Equity fund) http://www.axa.com.ph/FundFactSheets...ity%20Fund.pdf

Results 61 to 67 of 67

-

12-14-2012, 12:33 PM #61Newbie

- Join Date

- Nov 2008

- Gender

- Posts

- 26

Re: philam life, insular, prulife UK, UITF

Re: philam life, insular, prulife UK, UITF

-

12-14-2012, 01:17 PM #62Newbie

- Join Date

- Nov 2008

- Gender

- Posts

- 26

Re: philam life, insular, prulife UK, UITF

Re: philam life, insular, prulife UK, UITF

your comment is irrelevant, the commission for the agents is shouldered by the insurance company not by your investment, i suggest you attend a free licensing seminars conducted by all insurance company para kabalo ka sa imong mga ipang post.

insurance company only pay one time commissions on their agents on the 1st year and ranges from 20-50 percent of your premium paid..after ana the agents only minimal commissions from 5-10 percent till the 3 year. after the 3 year of premium payments it will all goes to the insurance companies portfolio investment.

-

12-14-2012, 03:22 PM #63

Re: philam life, insular, prulife UK, UITF

Re: philam life, insular, prulife UK, UITF

Ang gicover sa insurance commission are life insurance companies, not investments.

FAMI and PEMI have risks since investments man ni. Investments have risks.

But the risks aren't that much kay these companies are highly regulated by SEC.

Normally, P5T lang ang minimum to start a MF account.Pila pud starting ani and pila ka years pde ko maka withdraw if needed nako ang kwarta?

You can withdraw it any time. You can also add to your investments any time.

Be mindful lang about the holding period kay if you make withdrawals within the holding period, naay charges.

In terms sa returns, di ta makaingon pila since magvary man and will depend on the performance of the market/economy.Pila ang average interest per year ani bro? Pila pud madeduct sa ako investments for agent fees and etc?

Entry or exit fees lang ang macharge sa imong investment which range from around 2% to 5%. Mao lang na ang charges. Diha na pud gikan ang commissions sa agents and other fees.

Generally, mutual fund companies na ang magshoulder sa mga taxes.

-

12-15-2012, 02:09 PM #64

Re: philam life, insular, prulife UK, UITF

Re: philam life, insular, prulife UK, UITF

@makie:

You're from Philam Life, right? May you share with us what's the inclusion of your policies with merely regular premium and those with riders? Just give a technical example that we may have a picture of your life insurance policy whether term or variable. Thank you.

-

12-15-2012, 06:18 PM #65

Re: philam life, insular, prulife UK, UITF

Re: philam life, insular, prulife UK, UITF

Daghan man kaayo products ang Philam Life, maglisod ko ug quantify. What I'll do lang is to show/illustrate the benefits/features that are present in all plans/products (regardless if ordinary life or unit-linked).

Guaranteed Life Insurance Protection - For term life, you have the option to choose between 5 or 10 years of coverage or coverage of up to age 65. For whole life, you'll have a coverage of up to 100. Premiums are fixed within the term and you won't need any proof of insurability if you decide to continue the plan after the term expires.

Riders:

Accident and Health (A&H) - Provides additional assistance for dismemberment or total and permanent disability. It also provides medical reimbursements

Accidental Death Benefit (ADB) - For deaths caused by accidents, the beneficiaries will get an additional amount equivalent to the coverage. Basically, it doubles the amount received by the beneficiaries.

Wavier of Premium (WP) - Waives all remaining premiums in case of disability of the policy owner.

Mediguard - Provides daily allowance (at least P800/day) for hospitalization, ICU confinement, and surgery assistance

Lifeline - Provides coverage for critical illnesses upon diagnosis

Guardian - Attachable term insurance to further increase protection for 1, 5, 10, 20 years, or until you reach 65.

Philam Life also has Cancer Life Shield which provides assistance for cancer treatment. It provides lump sum cash benefit upon cancer diagnosis, quarterly cash support, daily hospital allowance, surgical assistance, and outpatient treatment support.

-

12-15-2012, 07:30 PM #66

Re: philam life, insular, prulife UK, UITF

Re: philam life, insular, prulife UK, UITF

@makie:

Thanks for the response.

Ganahan unta ko Term Life pero kapoy sige renew (di pako in.ana katiguwang jud and basig buhi pako na expire na ang policy & daghan na kuti if kuha nasad balik ky ni increase na ang age) and no time magmonitor sa rates if MF's, stocks, etc mo invest separately.

Do you offer "whole" life insurance but with payment options of 5, 10, 20, 30 or "lifetime" or when you are capable of doing so?

If yes, what's the advantages and disadvantages of paying only a given term or paying for a lifetime?

diba naa mn mobayad ka for 10 years, dayon you can stop na ky sustainable na siya pero the benefits of the policy are still there till served...

i-clarify lang nako ha. ang whole life insurance ky subdivided into three, right?

Whole Life Insurance:

1. Traditional Whole Life Insurance

2. Universal Life Insurance

3. Variable Life Insurance

unsa diay difference anang tulo? kana tulo inyo gi offer?

with regards to term and whole life insurance, unsa sad advantages and disadvantages?

Term Life

- cheaper

- mo increase daw ang premium. di ko ka see sa whole picture ani, hehe

- mo expire so mo renew nasad and mas mahal na dayon possible daghan na kuti like pa medical pa, etc...

Whole Life

- with cash value that increases or naay interest and dividends (pero mas dako jud unta if ikaw na mismo ni directly invest)

- premiums will just be of the same value/ fix premium

Correct me if I'm wrong with my assumption:

If I want to keep the policy in a given term (ex. 10 years), Term Life insurance is good for me. (ky inig out, dako na ang premium? awhaha... sakto ba? wa kayo ko kasabot sa mo increase ang premium, pwede diay makuha ang gibayad kung buhi paka after the policy ends?

(ky inig out, dako na ang premium? awhaha... sakto ba? wa kayo ko kasabot sa mo increase ang premium, pwede diay makuha ang gibayad kung buhi paka after the policy ends?

If I want to keep the policy in a longer term or a lifetime, Whole Life insurance is the better option.

[because you are paying fix premium amount, mura raka gahuwat when ka mamatay (death benefit) or pila imo makuha (for retirement),...]Last edited by cebu.opportunities; 12-15-2012 at 07:48 PM.

-

01-02-2013, 12:30 PM #67

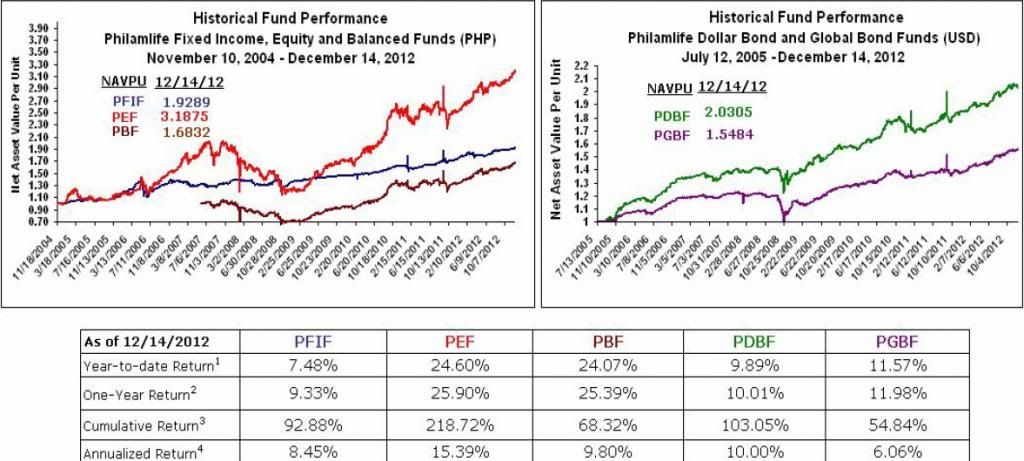

Here's the performance of Philam Life's ULP products up to Dec. 14, 2012

The equity funds has gone up by 24.60%, the balanced funds has gone up by 24.07%, and the fixed income fund has gone up by 7.48%. It's dollar and global bond funds did well as well at 9.89% and 11.57% respectively.

Is your money growing at the same rate?

The good thing about ULPs is that while your money is growing at such better rates, you get a life insurance coverage at the same time. It's hitting two birds with one stone since you get a protection (life insurance coverage) and a very fast growing investment at the same time with the same premium.

*Year-to-date return is the return from January 2, 2012 to Dec. 14, 2012

**One-Year return is the return from Dec. 15, 2011 to Dec. 14, 2012

***Cumulative return is the overall rate of return of the fund/s since its inception

****Annualized Return is the average rate of return of the funds every year

Just something to ponder on:

Interest rates on savings accounts is less than 1% per year (around 0.75% to be more accurate) and interest rates of time deposit accounts is around 3% per year. Average inflation rate is 3.2% for 2012. Inflation rate is the rate of increase of the prices of commodities per year. If your money is growing at 0.75% or 3% a year and prices are increasing at 3.2%, is your money really growing?

The key to successful investing and truly making your money grow is to put it into something that grows higher than the inflation rate.

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote