Results 31,861 to 31,870 of 32353

-

08-11-2016, 11:07 PM #31861

-

08-12-2016, 02:02 PM #31862

Unsay naa sa WEB pasira naman ta ni pero sige saka ang price? Nindot ipalit ani pero mora risky kayo..

-

08-12-2016, 05:12 PM #31863Newbie

- Join Date

- Aug 2016

- Gender

- Posts

- 29

Guys, im a newbie in trading stocks/shares. I heard about COL and Sun life. So col is a broker and Sunlife is where we put our shares? Is COL okay?

-

08-13-2016, 02:40 AM #31864Junior Member

- Join Date

- May 2014

- Gender

- Posts

- 147

Mu lang boss. Katawa ko gani sa iba na sige pangutana pero hanging kaau magtubag. Sa una murag naa koy gamay na bilib niya. By the time i learned technicals, hurot akong gamay bilib niya. Hahaha. Pero seriously, no harm in trying to buy books from "best selling authors". Different folks, different strokes jud.

I've been to seminars like iya ni Marvin Germo. Subscribed to daily newsletters of stockmarket pilipinas. Read tsupitero newsletters. Subscribed to Bo Sanchez TRC. Subscribed for 6 months with BOH. And during all those times, i've never clearly gained from those consistently. For me they "don't teach" me to earn consistently. They "spoon fed" me. The time I've indulge and passionately learned technicals, it resulted to consistent gains. And not just 5-10% holding it for weeks for months. But 10% or more holding those for 5 mins or half day or one day. So my advice to others, we just have numerous excuses to learn. We want it ora mismo. Di na ing ana pirmi. PhD jud need. Passion, hardwork, and discipline to learn and apply.

- - - Updated - - -

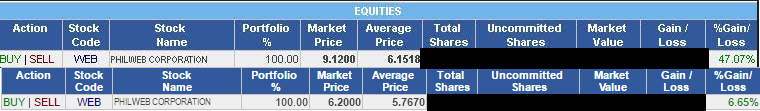

Congrats to WEB holders!

-

08-13-2016, 03:12 PM #31865

mga bai mo sukol pamo aning Semirara Mining & Power Corp? attractive kaau price niya run..

-

08-14-2016, 08:10 PM #31866

Philippine Stock Market – Update on selected stocks 8/12/2016

ANI, BLOOM, BRN, CAL, CEB, CIC, COSCO, CPG, CROWN, CYBR, DD, DMC, DNL, EDC, FLI, FNI, GERI, GLO, HVN, IDC, IMP, ION, IS, ISM, JGS, LC, LTG, MAXS, MEG, MPI, PGOLD, PLC, PPC, PXP, SBS, T

ANI - the price touches the Senkou Span line last Friday. Will this be the bottom for ANI? No rush. Wait for the bullish candlestick setup.

BLOOM - the Kijun Sen line was able to pull the price up with price even moving above 6.22 last Friday but wasn't able to sustain its rally. The KSL now acts as resistance. There is no bearish sentiment seen yet so a greater possibility for BLOOM to continue moving up. Will it be back to 7.x level soon?

BRN - sideways with bullish bias. It is still trying to bounce from the support slope.

CAL - Harami Cross on CAL but is it enough to signal a reversal? I would rather wait for a confirmation this week than to rush in

CEB - sideways with bearish bias. The stock is already at overbought level with RSI or Relative Strength Index at 85.8 based on weekly chart.

CIC - sideways with bearish bias.

COSCO - may continue to move down with support at 8.48 per share. Is it creating the handle for the cup?

CPG - went down by 3.1% last week. It failed to continue its ascend and may move sideways or consolidate while inside the Kumo or Cloud. Bearish sentiment is in the air for now. Immediate resistance is at 0.635 per share.

CROWN - registered a weak bearish signal last Friday after the price went below the Kijun Sen line but so far support at 2.21 per share was able to hold. This is still our support for this week while resistance is at 2.31 per share. It may move within this range this week with bearish bias.

Philippine Stock Market – Update on selected stocks 8/12/2016 | TLB – Philippine Stock Market

-

08-17-2016, 11:51 AM #31867

-

08-18-2016, 09:23 PM #31868

Sa katong nakapalit ganina sa WEB e.que nana ninyo daan. Gekulban na sa kaldiro ang WEB..

Pagcor rejects Ongpin’s offer to donate stake | Inquirer News

-

08-21-2016, 04:11 PM #31869

ALI - last week's price movement showed some bearish sentiment when ALI close the week with a Gravestone Doji. Will it retrace this week? Gravestone doji is a bearish signal when found at the top of the upward trend but it is a weak signal and needs confirmation.

ALT - sideways with bearisn bias.

ANI - still sitting at the support level. RSI o Relative Strength Index is at 30. Will it bounce this week? Test buy at current level

BDO - sideways with bearish bias

BEL - went down as low as 3.07 per share but bulls was able to close the price at 3.10 per share showing a bearish sentiment via Hammer candlestick. This type of candlestick is not a strong reversal signal so we need a confirmation via long green candlestick next week. Test buy at current level. If it will turn sour, next support is at 3.00 per share.

BHI - sideways with bullish bias.

BLOOM - sideways with bullish bias. Immediate support is at 6.41 per share

BPI - may still be able to hit 107.05 while no bearish candlestick pattern is seen yet. But the stock is already at the overbought level so its not good for a fresh entry.

BRN - sideways with bullish bias. Trading range is seen at 1.25 - 1.40 per share.

CEB - sideways with bearish bias. The stock is already at overbought level.

CHP - no bearish signal yet which means price may continue to move up withouth threat for now

COSCO - went up by 2% last week to continue with its upward trend. Will it be able to touch 9.7x level?

CPG - went down by 3.4% last week and so far no bullish signal found yet. This may continue to go down as Kumo try to pull the price down.

Philippine Stock Market – Update on selected stocks 8/19/2016

ALI, ALT, ANI, BDO, BEL, BHI, BLOOM, BPI, BRN, CEB, CHP, COSCO, CPG, CROWN, CYBR, DAVIN, DD, DMC, DNL, EDC, EEI, EW, FGEN, GERI, IDC, IS, ISM, LC, LPZ, LR, LTG, MAXS, MCP, PLC, PPC, PXP, T

Philippine Stock Market – Update on selected stocks 8/19/2016 | TLB – Philippine Stock Market

-

08-28-2016, 03:14 PM #31870

Philippine Stock Market – Update on selected stocks 8/26/2016

ALI, ALT, ANI, ARA, BDO, BEL, BHI, BLOOM, BPI, CAL, CEB, COSCO, CPG, DAVIN, DD, DNL, IDC, ION, LC, LPZ, LTG, MAXS, PLC, PXP, SBS

ALI - dropped by 5.8% to close at 38.70 per share. There might be some spikes this week but the stock is currently on correction mode. Currently sitting at the support line provided by 23.6% Fibonacci Retracement level while next support is at 36.44 per share.

ALT - went up by 11.7% last Friday and bulls are are still in control. It may continue to move up with immediate resistance at 4.76 per share then 5.58 per share. This is good for day trade.

ANI - after more than a month of decline, is it time for ANI to bounce? Currently at support level with green candlestick. Resistance at 3.54 per share in case it will go up.

ARA - closed at the high, this stock is still bullish. Will it break the previous high at 3.44 per share?

BDO - sideways with bearish bias. Most likely the price will be pulled down by the Kijun Sen line and Kumo

BEL - looks like the bulls are going to break the Kumo this week. If that happens, we will have a bullish signal via Kumo Break. Test buy at current level. Support at 3.10 per share.

BHI - sentiment is still bullish. It may continue to move and hit 0.106 per share which is our resistance. RSI or Relative Strength Index is at 56.8 which means buyers are still in control.

BLOOM - good bounce as it went up by 7.4% last Friday. It close at the high which means that bulls are in control. Next resistance is at 5.93 per share and while it is inside the Kumo or Cloud, expect some turbulence.

BPI - showing bearish sentiment last week but you may wait for a confirmation via a red large candlestick before expecting a deep correction. Otherwise it will continue to go up and hit 107 and beyond.

CAL - went up as high as 4.14 per share but loses steam and close at 3.36 per share. Chikou Span line shifted to a bullish territory but notice how the Kumo showed strong resistance. Will there be more for CAL this week? I think there is but it will be a rough ride. Not for the faint of heart.

Read more: Philippine Stock Market – Update on selected stocks 8/26/2016 | TLB – Philippine Stock Market

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote