Results 111 to 120 of 156

Thread: TAX info and updates

-

12-02-2011, 01:50 AM #111Junior Member

- Join Date

- Sep 2005

- Posts

- 251

Re: TAX info and updates

Re: TAX info and updates

-

01-10-2012, 09:56 AM #112Junior Member

- Join Date

- Sep 2005

- Posts

- 251

Re: TAX info and updates

Re: TAX info and updates

Deadline for this month:

1. Withholding on Compensation (1601C) - deadline January 15, 2012;

2. Monthly Remittances Return of Creditable Income Tax Withheld (1601E) - deadline January 15, 2012;

3. Filing of Percentage Tax (2551M) - deadline January 20, 2012;

4. Filing of VAT (2550M) - deadline January 25, 2012;

5. Alphalist / Annual Information Return of Income Taxes Withheld on Compensation (1604-CF)- deadline January 31, 2012;

6. Annual Information Return of Creditable Income Taxes Withheld (Expanded) 1604E - deadline February 28, 2012; and

7. Renewal of Business Permits - deadline January 31, 2012

Please be guided accordingly!

-

01-14-2012, 01:24 AM #113

Re: TAX info and updates

Re: TAX info and updates

pwede ko mg patabang sa ako nalibogan?! married meh den xa ng claim sa 2 dependent (2 daughters) ang sa ako wife nga gross per month is around 6k (dapat 3k pero naa mga decutions like pag-ibig, sss, phil health) den wala xa giibanan sa monthly tax niya pero last dec 31 nga sweldo gideduct xa more than half sa iyang salary dapat mka receive xa 2900 pero iyang tax kay around 1600+ ingon iya hr quarterly daw kuno... labi na ang ila head office kay sa manila... ng start xa work last sept. 16... dba gpataasan man ang tax exemption? iya sweldo kay minimum wage man dba?!

nglibog sad jud ko kay ang uban niyang mga kauban nga staff gamay ra nun ug tax (naay tg200 lng bisan medyo taas2 ug rate compare sa ako wife nga 6k monthly) nga single pman gani... wala ba kaha ng bailo?!

salamat nya sa mutubag

-

01-14-2012, 09:04 AM #114Junior Member

- Join Date

- Sep 2011

- Posts

- 115

Re: TAX info and updates

Re: TAX info and updates

up ko ani nga thread...

vincedin is my friend......

-

01-14-2012, 10:02 AM #115

Re: TAX info and updates

Re: TAX info and updates

For individuals earning aound 6k, gagmay ra man ang deductions sa PhilH, Pag-Ibig and SSS, by bracket man na unless if you opt to be deducted more than waht the bracket says.

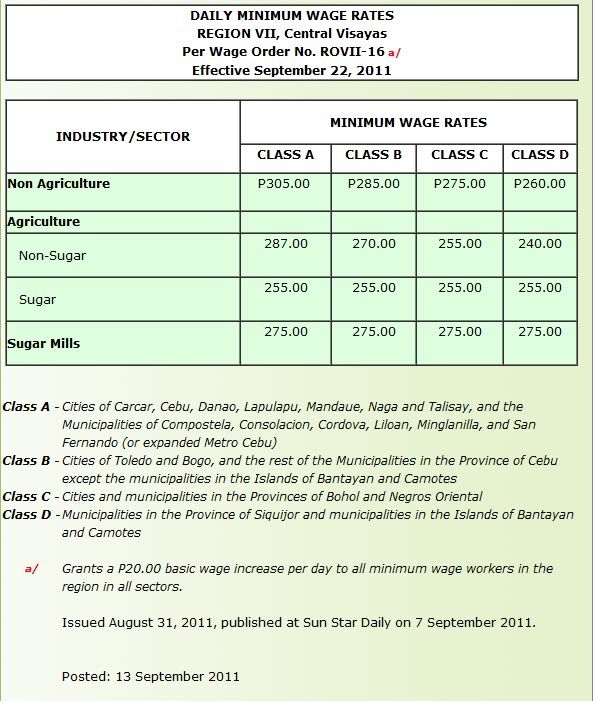

Anyway, Minimum wage earners are not to be taxed. Pls refer to this R.A. 9504, focus of section 2 . Pwede pud i-print unya ipakita didto sa HR. Walay quarterly-quarterly ana oi! There is no problem if sa head office pa is in manila. U must fight on this! Maybe dili lang ang imu wife ang nkasuway ani.

There is no issue on exemptions kay MWE man imu wife.

I-clarify lang jud na. Ipakita una ang payslip kay murag nagkabaylo jud na xa bro. If moingon nga sakto ang payslip then u can present the doc stating that MWEs are exempted from the payment of income tax on their taxable income: Provided, further, That the holiday pay, overtime pay, night shift differential pay and hazard pay received by such minimum wage earners shall likewise be exempt from income tax.

Pls update or PM me after buhaton ni nimu and tan-awon nato if unsa ato next himoun.

-

01-14-2012, 11:50 AM #116

Re: TAX info and updates

Re: TAX info and updates

kay ingon pa nila naa pa jud na mga mahitabo nga ity nlng daw... salamat bai.. unsaon ang hr man gud nila sa office kay d man jud hr... mao wala jud xa kabalo sad... ang mao man daw girason sa taga head office...

karon sir unsa nman ang angay buhaton? pwede pa ba mahabol?

salamat bro ako nya ad2... ay librarian man ako wife sa usa ka compt skul... naa pa gani sa mga instructor nga mga questionable kau...

salamat kau bro... mo pm nlng nya ko o ako ipost dri ang ila reply...

-

01-14-2012, 02:48 PM #117

-

01-16-2012, 08:44 AM #118

Re: TAX info and updates

Re: TAX info and updates

bai gi ingnan rman xa ng mgfill pa daw xa waiver for exemption... kay married pa daw ang nka butang... pero nka submit n gani xa sa birth certft. sa among mga anak...

-

01-16-2012, 11:12 AM #119

Re: TAX info and updates

Re: TAX info and updates

FYI: Under the law bro, sa husband i-deduct ang tax exemption sa 4 siblings unless he(you) make a waiver stating that u waived that right.

But on ur wife's case, no need na ang exemption kay as what u said, minimum wage earner (MWE) sya. Nganu man naa pay exemption nga MWEs are exempted from the payment of income tax on their taxable income?

-

01-16-2012, 12:15 PM #120

Re: TAX info and updates

Re: TAX info and updates

mao jud minimum wage earner gud xa... kng computon 72000+ ang gross income niya annual kng naa tax minimal lng dba?

sagdi lng icomply lng ni namu mgkuha meh form (BIR said form 2305 and the waiver daw) den kitaon nato..

pero ang kad2ng sobra nga gideduct niya gingon pa sa hr kay apil na daw ang jan-dec 2011 den start xa sept. na bya...

Similar Threads |

|

Reply With Quote

Reply With Quote